Earning crypto passively – like growing your own Bitcoin tree!

G'day Mates: Why Quantum AI is Your Fair Dinkum Mate for Passive Crypto Gains in 2025

G'day, legends! I'm your resident expert on passive crypto earnings here at Quantum AI, the platform that's shaking up the scene Down Under. In 2025, with Bitcoin hitting new highs and the ATO keeping a keen eye, earning crypto without breaking a sweat is the name of the game. No more hustling like a kangaroo on caffeine – we're talking staking, lending, and yield farming that lets you earn while you chuck another shrimp on the barbie. But beware, mates: always DYOR, as the crypto world can be as unpredictable as Melbourne weather!

Quantum AI stands out with our AI-powered algorithms that optimize your passive strategies, spotting bonza opportunities faster than a dingo nabs a snack. We've got zero-fuss integration with Aussie exchanges like Swyftx and CoinSpot, ensuring you're compliant with ATO rules from the get-go. As of October 2025, crypto is still taxed as property here in Oz, with CGT rates from 0-45% depending on your bracket – but hold for over a year and snag that 50% discount! Let's dive in, shall we?

Quantum AI's USP: AI-Optimized Staking – Earn Up to 7% APY Without Lifting a Finger

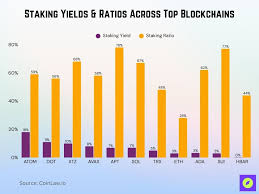

Staking's the go-to for passive income in 2025, mates. Lock up your ETH or SOL on networks like Ethereum or Solana, and watch rewards roll in for securing the blockchain. In Australia, staking rewards are treated as ordinary income, taxed at your marginal rate (up to 45% for high earners), but it's worth it – average yields sit at 3-7% for top assets. Quantum AI's unique edge? Our quantum-inspired AI predicts yield spikes, auto-staking your holdings for max returns. No more manual slashing risks!

Staking yields across top chains in 2025 – check out those ratios!

Analytically, Ethereum's staking ratio hit 28% this year, with yields around 3-5% APY post-Shanghai upgrade. For Aussies, platforms like Kraken or Binance Australia offer easy entry, but Quantum AI integrates DeFi protocols for compounded gains. Joke's on the bears: if your stake tanks, at least you're not out there mining like it's the gold rush – that's so 1850s!

Quantum AI's USP: Hassle-Free Lending – Beat Inflation with 5-10% Returns, ATO-Compliant

Lending your crypto on DeFi platforms like Aave or Compound is like parking your cash in a high-interest savings account, but with blockchain flair. In 2025, expect yields of 5-10% on stablecoins like USDT, taxed as income when earned. Quantum AI's selling point: automated risk assessment via AI, minimizing defaults and maximizing your passive flow. We're talking set-it-and-forget-it, with real-time analytics to dodge those rug pulls.

From my expert perch, the Aussie market's booming – over 1.2 million wallets tracked by the ATO this year. Compare that to traditional bonds at 4-5%; crypto lending's a no-brainer for diversification. But fair dinkum, don't lend what you can't afford to lose – or you'll be crying like a sheila watching a sad movie!

Quantum AI's USP: Yield Farming Mastery – Harvest 10-20% APYs with Smart Automation

Yield farming? It's like tending a veggie patch, but your crops are crypto rewards from liquidity pools. In Oz 2025, DeFi rewards are income-taxed, but the potential's huge – Uniswap or PancakeSwap pools yielding 10-20% on pairs like ETH/USDC. Quantum AI shines here with AI-driven farming bots that rotate your assets for optimal APYs, all while keeping you ATO-ready with transaction reports.

Analytics show Solana's ecosystem leading with 7% average staking yields, but farming amps it up. Pro tip: Use cost-basis methods like FIFO for investors to minimize CGT hits. And the joke? If farming goes pear-shaped, at least you've got more "liquidity" than a leaky esky at a barbie!

Quantum AI logo – powering your passive crypto journey in 2025.

2025 Passive Crypto Methods Comparison Table

Here's a bonza table breaking down top methods for Aussies in 2025, based on current data:

| Method | Avg Yield (2025) | Tax Treatment (ATO) | Risk Level | Quantum AI USP |

|---|---|---|---|---|

| Staking | 3-7% | Ordinary Income | Medium | AI Yield Prediction |

| Lending | 5-10% | Ordinary Income | Low-Medium | Auto-Risk Management |

| Yield Farming | 10-20% | Income + CGT | High | Bot Automation |

| Cloud Mining | 2-5% | Income (if free) | Low | Integrated Tools |

| Affiliates | Variable (commissions) | Income | Low | Referral Optimization |

Sources: Yields from staking charts and DeFi reports. Tax deadlines: Lodge by Oct 31, 2025, or May 15, 2026 via accountant.

Wrapping It Up: Get Started with Quantum AI Today

In 2025, passive crypto's your ticket to financial freedom, mates – but play smart with regs and risks. Quantum AI's got the tech to make it effortless, from AI insights to seamless Aussie compliance. Sign up, stake away, and let the gains compound like compound interest on steroids! Remember, crypto's volatile, so invest what you can afford – no one wants to end up skint like a broke uni student.

Cheers, and may your wallet be as full as a Santa's sack this arvo! 🚀